Introduction

This note reviews how fluid milk is priced in Canada and in the US. The main conclusions are that managed producer prices provide stability and that regulation encourages quality and good husbandry. The report shows clearly that Canadians are not seriously disadvantaged as to the price of fluid milk relative to their US counterparts.

National Price Comparisons

The first chart compares the producer price indexes for fluid milk in Canada and the US. Price indexes only measure the change in price, not the price itself. The chart shows that, in 2022, US milk prices grew much faster than the Canadian equivalent.

These indexes are for the prices at the processor level. In Canada, the Canadian Dairy Commission administers farm gate prices to ensure a fair compensation to producers that reflects average supply costs. Coupled with supply quotas, this provides a stable marketing environment for producers and processors.

Canadian Dairy Commission -link

The producer price comparison provides the most useful perspective of actual milk costs. Retail prices are another perspective but there are a lot of other actors involved including retailers. There is significant variation in retail prices because of local market conditions, milk brand, milk type and other factors. The average retail price for milk, scaled to a 4lt package, is shown below.

In the US, the fluid milk market is managed with Federal Milk Marketing Orders administered by areas. In Federal order provisions, dairy processors are referred to as handlers and dairy farmers are known as producers. A marketing area is generally defined as a geographic area where handlers compete for packaged fluid milk sales, although other factors may be taken into account when determining the boundaries of a marketing area.“Federal orders serve to maintain stable marketing relationships for all handlers and producers supplying marketing areas, thus facilitating the complex process of marketing fresh milk.”

Federal Milk Marketing Orders - Note: US government links are in a state of flux

Retail Prices

The next chart shows provide a comparison of national retail prices in the two countries.

A number of factors including market structure affect the aggregates. Milk prices vary by fat content and location. In the US, the milk marketing orders establish only the minimum price to the processor. Market conditions will be a factor.

The complexities of pricing vary by market. The example below discusses New York state.

Farm and Retail Milk Price Relationships in New York This report provides examples of some price regulations for regulating the difference between the processor price and the retail price.

What the Farmer Gets

In both Canada and the US there is a deemed revenue that producers must receive from fluid milk, it doesn’t translate directly to a famer’s paycheque. In both countries, milk is paid on a blended price of all dairy activity from raw milk. A producer never directly sees those higher fluid farmgate prices as it’s blended with other industrial processing activities like cheese and butter that reduce that blended return.

Although there is a farmgate price to producers, in reality there is no such thing as a specific fluid farmgate price.

For Canada, the notional farm gate price for fluid milk is shown below. The Canadian Dairy Commission develops prices based on the butter fat price and the price for milk solids. The average butter fat composition of milk was 4.33 kg/hl. Hl is a hectoliter or 100 litres.

Canadian Milk Class Prices - Canadian prices

The graphic below shows calculations provided by the Canadian Dairy Commission. This suggests that the retail price is only 25% above the farm gate price.

This suggests to me that the milk processing and distribution system is relatively efficient in Canada.

Regional Price Variations.

The next chart shows the average retail price by province for Canada.

The next chart shows US prices for whole milk for selected cities. Note that the variations even within states are significant.

The data are collected by the Agricultural Marketing Service of the US Department of Agriculture. In some markets, the prices appear to be higher than similar markets in Canada.

The next chart translates the same data into Canadian terms

.The country-wide multi-city average for whole milk was $US4.39 for a US gallon (3.78 litres). Adjusting for the exchange rate (1.42) and converting to the metric 4-litre measure used in Canada gives a US retail price of $5.89. New York city is much higher at $6.78. Statcan (18-10-245) showed that the Ontario average price for 4 litres of milk was $6.51 in December. The key message is that price comparisons are the retail level are complex but the Canadian prices appear to be comparable to similar markets in the US.

Milk Quality

When one adds quality considerations into the picture, our dairy commission looks even better. Our standards are higher.

The standard quality indicator for fluid milk is the somatic cell count. Lower limits are better for animal welfare. The US limit is 750,000 cells per milliliter (mL). The Canadian limit is 400,000. This is a policy choice that is independent of the pricing regimes.

Dairy Extension discussion of milk quality.

In the US, an artificial bovine growth hormone called rbST or rBGH may be used to boost milk production. Health Canada has not approved its use because of concern for animal welfare because it can be associated with problems such as mastitis and other bovine diseases. This choice is also independent of the pricing regime.

Subsidies

Subsidies are payments from government to producers to modify their pricing behaviour.

US Dairy Specific Programs

Source:

Falling Milk Prices Led to Record Program Payments for Dairy Producers in 2023

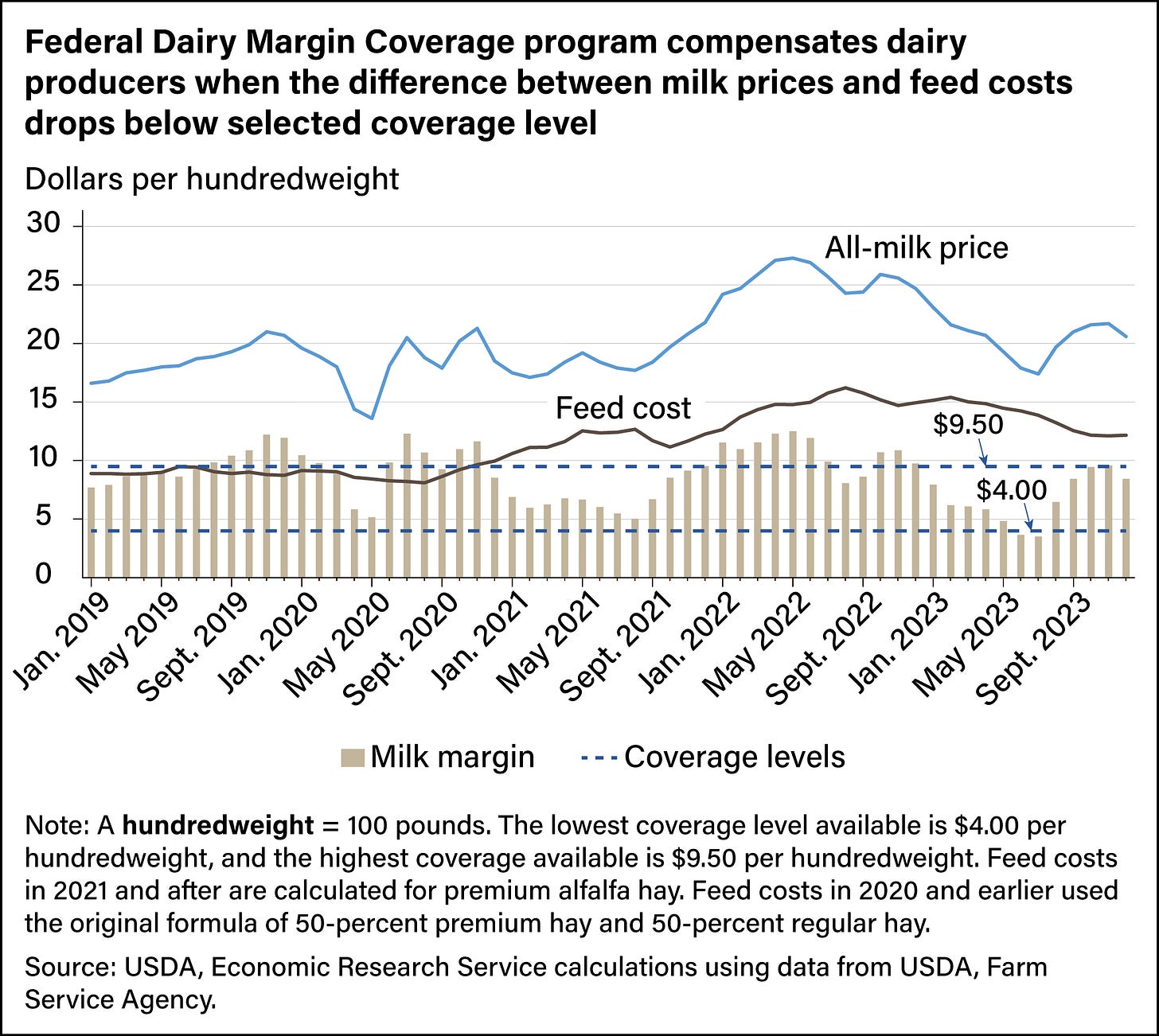

The chart shows the impact of the subsidies at the basic unit of 100 pounds of milk,

The Dairy Margin Coverage (DMC) program provides dairy operations with risk management coverage when margins fall below a selected coverage level. In 2021, payments to dairy operations under the DMC program totaled $1.188 billion, about a fivefold increase from 2020, due to higher feed costs and greater program participation. Additional retroactive payments were made for 2021 and 2022 through Supplemental DMC provisions.

Source:

Crop and disaster insurance and other compensation are available in the US as well.

Canadian Milk Subsidies

With the recent USMCA, access commitments were made for US dairy products to enter the Canadian market. The Dairy Direct Payment Program is intended to offset the impact. Under the program, eligible dairy producers receive payments on the basis of their milk quota. It offsets potential lost sales but does not translate into the managed prices.

From 2023-24 to 2028-29, the program will make available a total of $1.2 billion in compensation for the impacts of the Canada-United States-Mexico Agreement (CUSMA).

The annual commitment declines over time:

$250 million will be made available in 2025-26

$150 million will be made available in 2026-27

$150 million will be made available in 2027-28

$100 million will be made available in 2028-29

There are no other subsidies required because of the supply management program which manages farm gate prices around annual surveys based on the cost structure of the efficient farms.

Avian Flu Risks

Recently, I published a substack showing the impact of management of avian flu on the population of laying hens in the US and Canada. It is a negligible economic problem here but a big expensive problem in the US.

One of the major concerns is the spread of this bird-originated virus to mammals and specifically cattle. In mammals, the virus has a greater chance of spreading to the human population and possibly leading to another pandemic.

Animal Health Canada has released a review of the issue. “As of February 10, 2025 Highly pathogenic avian influenza – HPAI (H5N1) has been detected in 964 affected premises in all livestock in 17 states in the US.“

US Detections of H5N1 in cattle.n - source material

There have been no cases in Canada. “As of January 31, 2025, CFIA laboratories have tested 1944 samples of raw milk arriving at processing plants in all provinces across Canada. All samples have tested negative.“

Summary

The report shows clearly that Canadians are not seriously disadvantaged as to the price of fluid milk relative to their US counterparts. However, our dairy policies offer other advantages.

Canadian policy has led to a safe productive environment for dairy farmers to provide us the products that we need with hormone-free fluid milk. This is done without the big swings in producer prices and complex pricing mechanisms as in the US. It is important for us that we retain the blue-cow advantage of price stability and quality.

Thank you, thank you, THANK YOU for this careful analysis, Mr. Jacobson. Now if only someone would tell folks at the Globe and Mail to quit publishing anti-Canadian claptrap about our well-regulated dairy supply management system. (I'm thinking especially of Rita Trichur, a business reporter who seems to specialize in attacking it.)